Ok ladies & gentlemen... I know that last week was a slow week in my world of saving and that I promised you that this week would be much more exciting. I went on about how once a month I take 1 paycheck and divide it up into 3-4 different deposits into different accounts, but unfortunately you're going to have to wait another month for that.

I had pre-planned for some time out of work to recuperate from my gallbladder surgery, but we had some other expenses come up as well. So sadly I will be starting off 2013 by not putting any money in to my money market savings or my car savings. I will add another $20 to my vacation fund for this week at least!

I'm going to take this weeks paycheck, which was for $601.79, and put 100% of it towards paying down my Discover card bill. I also got a check from my car insurance company to pay me back for a deductible which they insist they owe me even though I never paid it. That check is for $500 and I will be putting that toward the Discover bill also. Paying $1100 on my Discover will lower the bill to between $200-$300 which will easily be paid next month.

So let me give you the week 4 wrap up:

$38.26 to my 401K

$20 to my vacation fund

which makes the 2013 totals...

$165.07 in my 401K

$80 in the vacation find

$9.05 in the piggy bank

Sorry to let you guys down, but saving money usually is not exciting. I do promise that in the next month or two you will get a detailed breakdown of me taking one paycheck and putting it into multiple accounts is a truly OCD fashion! There will also be more deposit cans in the near future to add some more cash saving to the piggy bank!

I"m not sure what will happen next month because I will be getting some paychecks from my actual work, but most of the money for the first 2 weeks will be coming from the temporary disability insurance company paying for my time out from gallbladder surgery. No matter what happens I will give you all the details on all the money and where it goes as soon as I have some more income.

Friday, January 25, 2013

Friday, January 18, 2013

Week #3 - Friday January 18th

Let me say right off the bat that this is a VERY slow week in the world that is my OCD budgeting. Like I mentioned in an earlier post I have a set up that dictates what I do with each paycheck and last weeks check and this weeks check both go toward paying my mortgage. Wait until the next paycheck comes in though, that's the one that will get split between at least 2-3 different accounts! I promise you.... shit is about to get real!

So... this weeks paycheck is for the same exact amount as last week, $602.79 and all of it will go into my 'mortgage' account. This week I will also schedule the mortgage payment to be deducted from that account sometime in the last week of the month, maybe around the 29th. This week there was another $38.26 taken out pretax and put into my 401K account.

The only other thing that I did this week in the realm of saving was my usual $20 transfer from my regular checking account into my vacation saving account. I still have some more deposit cans at work and a few more at home that need to be returned, but I will probably wait a couple of weeks before I do that again.

This weeks savings were....$38.26 in my 401K

$20 in the vacation fund

which makes the 2013 totals...

$126.81 in my 401K

$60 in the vacation find

$9.05 in the piggy bank

I also want to tell you that there could be some disruption to my budgeting schedule, which upsets me! I have to have my gallbladder taken out next Tuesday and will be out of work for at least 2 weeks. I will be getting paid through a temporary disability insurance which will give me a % of my normal 40 hour paycheck, but I'm not sure what days those checks will come in the mail. I'm also not sure how much money each check will be for so my saving might be stunted for a few weeks! In true OCD fashion I wont deposit those checks until the day they should have gone in (or as soon as I get them if they are late). I will keep updating the blog as money is deposited, but it might not be every Friday for the next 2-3 weeks.

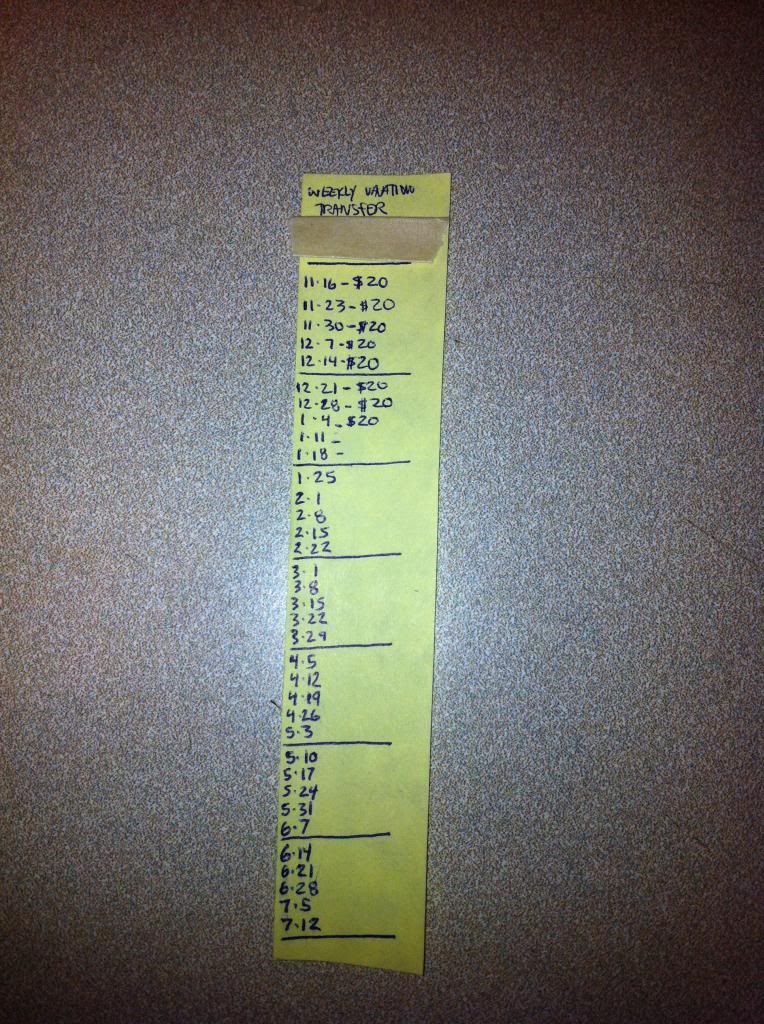

As this weeks added bonus I present to you the little yellow paper that I use to keep track of my 'vacation transfers'. It's a trimmed down post-it-note that I keep in my checkbook. It has the date of a bunch of Fridays written down the side and they are separated in sections of 5 dates (which would equal $100 per section). I just write in '$20' next to the date after I make the transfer each week..... I told you I was crazy!

So... this weeks paycheck is for the same exact amount as last week, $602.79 and all of it will go into my 'mortgage' account. This week I will also schedule the mortgage payment to be deducted from that account sometime in the last week of the month, maybe around the 29th. This week there was another $38.26 taken out pretax and put into my 401K account.

The only other thing that I did this week in the realm of saving was my usual $20 transfer from my regular checking account into my vacation saving account. I still have some more deposit cans at work and a few more at home that need to be returned, but I will probably wait a couple of weeks before I do that again.

This weeks savings were....$38.26 in my 401K

$20 in the vacation fund

which makes the 2013 totals...

$126.81 in my 401K

$60 in the vacation find

$9.05 in the piggy bank

I also want to tell you that there could be some disruption to my budgeting schedule, which upsets me! I have to have my gallbladder taken out next Tuesday and will be out of work for at least 2 weeks. I will be getting paid through a temporary disability insurance which will give me a % of my normal 40 hour paycheck, but I'm not sure what days those checks will come in the mail. I'm also not sure how much money each check will be for so my saving might be stunted for a few weeks! In true OCD fashion I wont deposit those checks until the day they should have gone in (or as soon as I get them if they are late). I will keep updating the blog as money is deposited, but it might not be every Friday for the next 2-3 weeks.

As this weeks added bonus I present to you the little yellow paper that I use to keep track of my 'vacation transfers'. It's a trimmed down post-it-note that I keep in my checkbook. It has the date of a bunch of Fridays written down the side and they are separated in sections of 5 dates (which would equal $100 per section). I just write in '$20' next to the date after I make the transfer each week..... I told you I was crazy!

Friday, January 11, 2013

Week #2 - Friday January 11th

Ok... so its payday and I just got my paycheck. Usually at this point I take out my checkbook and balance it to what it says at my bank online, but I did that the other day so its all set for now.

This is paycheck #2 for the month of January which based on my system (which I seldom waver from) means that it goes into my 'mortgage' checking account. It takes about 2 paychecks to cover the mortgage on the house and my wife takes care of the other house bills & utilities. She recently got some extra work from her job which will mean some extra money that might go towards paying the mortgage down, but I wont get into that for at least a couple more weeks once I know more.

So today's paycheck was $602.79 which is actually a little less than I thought it would be for a 40 hour week because for some reason my social security tax went up $18.53 this week.

Now all $602.79 will go into the one 'mortgage' account, but that doesn't mean I wont save anything this week. I will make a $20 transfer from my regular checking account into my 'vacation' account. You may be wondering why I don't set it up as a reoccurring transfer every Friday or why I don't just make on transfer per month for $80 ($20 per week)? Well the answer to that is I'm OCD and I like to move the money myself exactly when I want it moved.

I also had a little bonus save this week. I went to Stop & Shop and returned some deposit cans & bottles that we had from the last couple of months. Some people return cans to get the money back that they paid as a deposit when they bought the soda, but one of the benefits of living in Rhode Island is that most of the cans & bottles are stamped with a .05 cent Massachusetts deposit, but there is no deposit in Rhode Island. So for every can we buy in RI and return to MA we actually get .05 cents of free money. I've been doing that for awhile now and I keep all that money in a small piggy bank. This weeks trip netted $9.05 in can money.

This weeks savings were....

$38.26 in my 401K

$20 in the vacation fund

$9.05 in the piggy bank

which makes the 2013 totals...

$88.55 in my 401K

$40 in the vacation find

$9.05 in the piggy bank

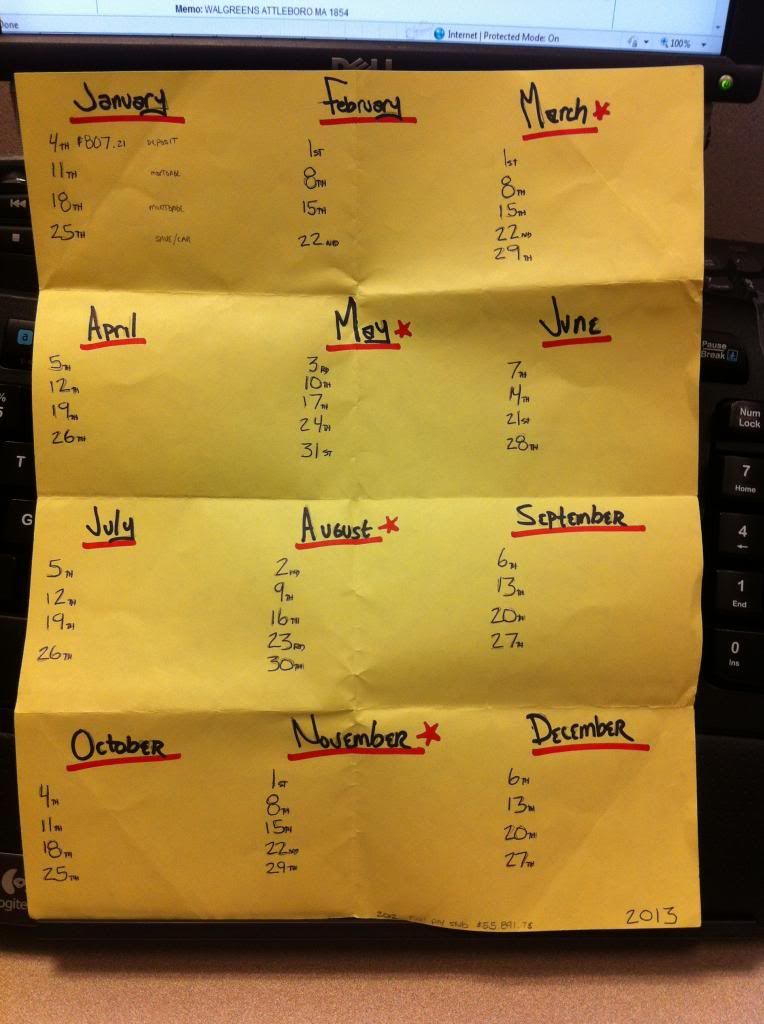

To give you a glimpse into how crazy I actually am here is a picture of the sheet of paper I use to do my budget. I take a yellow piece of paper from work and I write out all the months and pay dates (all the Fridays) on it. Then each week when I get my check I write in the full dollar amount and I write in where the check is going (checking, money market, mortgage, etc). I am totally serious about this. I've been doing it this way for about 5 years and a the end of the year I paperclip this sheet of paper to my calendar and put it on a book shelf.

This is paycheck #2 for the month of January which based on my system (which I seldom waver from) means that it goes into my 'mortgage' checking account. It takes about 2 paychecks to cover the mortgage on the house and my wife takes care of the other house bills & utilities. She recently got some extra work from her job which will mean some extra money that might go towards paying the mortgage down, but I wont get into that for at least a couple more weeks once I know more.

So today's paycheck was $602.79 which is actually a little less than I thought it would be for a 40 hour week because for some reason my social security tax went up $18.53 this week.

Now all $602.79 will go into the one 'mortgage' account, but that doesn't mean I wont save anything this week. I will make a $20 transfer from my regular checking account into my 'vacation' account. You may be wondering why I don't set it up as a reoccurring transfer every Friday or why I don't just make on transfer per month for $80 ($20 per week)? Well the answer to that is I'm OCD and I like to move the money myself exactly when I want it moved.

I also had a little bonus save this week. I went to Stop & Shop and returned some deposit cans & bottles that we had from the last couple of months. Some people return cans to get the money back that they paid as a deposit when they bought the soda, but one of the benefits of living in Rhode Island is that most of the cans & bottles are stamped with a .05 cent Massachusetts deposit, but there is no deposit in Rhode Island. So for every can we buy in RI and return to MA we actually get .05 cents of free money. I've been doing that for awhile now and I keep all that money in a small piggy bank. This weeks trip netted $9.05 in can money.

This weeks savings were....

$38.26 in my 401K

$20 in the vacation fund

$9.05 in the piggy bank

which makes the 2013 totals...

$88.55 in my 401K

$40 in the vacation find

$9.05 in the piggy bank

To give you a glimpse into how crazy I actually am here is a picture of the sheet of paper I use to do my budget. I take a yellow piece of paper from work and I write out all the months and pay dates (all the Fridays) on it. Then each week when I get my check I write in the full dollar amount and I write in where the check is going (checking, money market, mortgage, etc). I am totally serious about this. I've been doing it this way for about 5 years and a the end of the year I paperclip this sheet of paper to my calendar and put it on a book shelf.

Maybe next week I'll show you how I keep track of my $20 vacation transfers!

Monday, January 7, 2013

A New Year - January 2013

I was inspired to start this blog by Jen Tobin and her blog at www.savingitall.wordpress.com. She tells her adventures of saving money for her daughters future schooling and saves money in many ways from a 401K to digging bottles & cans out of random trash cans to recycle them for cash.

I have been doing pretty well saving money the last few years mainly be sticking to my very strict obsessive schedule and I hope this blog can show you that its possible to save money even if you don't have a ton to begin with. In the interest of not disclosing everything I will use a base number of zero for the year and I will just document what I save each week (if I keep posting on here). My plan is to try and post on Fridays, but today is Monday January 7th so I'm giving you a brief introduction and I will fill you in on last weeks money going-ons.

So I have a system based on a normal 4 paycheck month. The 1st paycheck is deposited into my regular checking account and used for gas, food, records, comic books, movies and whatever else I want to do in a month. I also deposit $20 per week from my regular checking account into my 'vacation savings' account for an eventual vacation. The 2nd & 3rd paychecks of the month are deposited into my 'mortgage' checking account which I use only to pay the mortgage. The 4th paycheck of the month is split into 3-4 accounts each month. Usually I deposit $25 into an account of saved money for potential vet bills for my 12 year old 20 pound cat named Beetus. $50 is deposited into an account for an outstanding interest free loan that I pay down by about $800 per year. The remainder of that 4th paycheck is then divided in half and split between my money market account and what I call my 'car' account. The money market is what I consider to be my main savings. The goal is for money to go in and never come back out! The car account is money I save in case I need to have a repair done to my car or to eventually use when I need, or give into the want for, a new car. Budgeting money for a car when you have no car payment may seem silly, but it has saved me when I needed a new windshield and 4 tires before I could get an inspection sticker!

I want to say that I started the year with credit card debt of about $1300 from Christmas and a few other things. This is the highest credit card bill I have carried and paid interest on in years. I use my Discover card for many things to earn the 'cash back bonus', but I usually pay the bill off each month. That did not happen prior to the new year and my goal is to not use any previously saved money to pay off the bill.

The paycheck that I got on Friday January 4th was for $807.21. After I deposited it at the bank I did my weekly transfer adding $20 to my vacation fund and I made a $400 payment on my Discover bill lowering it to under $1000, but I will have to use it for gas and a few other things over the next month. I also had $50.59 taken from my check and put into my 401K, pre-tax of course.

Ok... so my current total for 2013 so far is a whopping $20 in my vacation fund and $50.59 in my 401K

Hopefully if this goes as planned I will see you this coming Friday and each Friday following with brief updates on what money goes where.

Feel free to comment with your own stories of saving and spending!

I have been doing pretty well saving money the last few years mainly be sticking to my very strict obsessive schedule and I hope this blog can show you that its possible to save money even if you don't have a ton to begin with. In the interest of not disclosing everything I will use a base number of zero for the year and I will just document what I save each week (if I keep posting on here). My plan is to try and post on Fridays, but today is Monday January 7th so I'm giving you a brief introduction and I will fill you in on last weeks money going-ons.

So I have a system based on a normal 4 paycheck month. The 1st paycheck is deposited into my regular checking account and used for gas, food, records, comic books, movies and whatever else I want to do in a month. I also deposit $20 per week from my regular checking account into my 'vacation savings' account for an eventual vacation. The 2nd & 3rd paychecks of the month are deposited into my 'mortgage' checking account which I use only to pay the mortgage. The 4th paycheck of the month is split into 3-4 accounts each month. Usually I deposit $25 into an account of saved money for potential vet bills for my 12 year old 20 pound cat named Beetus. $50 is deposited into an account for an outstanding interest free loan that I pay down by about $800 per year. The remainder of that 4th paycheck is then divided in half and split between my money market account and what I call my 'car' account. The money market is what I consider to be my main savings. The goal is for money to go in and never come back out! The car account is money I save in case I need to have a repair done to my car or to eventually use when I need, or give into the want for, a new car. Budgeting money for a car when you have no car payment may seem silly, but it has saved me when I needed a new windshield and 4 tires before I could get an inspection sticker!

I want to say that I started the year with credit card debt of about $1300 from Christmas and a few other things. This is the highest credit card bill I have carried and paid interest on in years. I use my Discover card for many things to earn the 'cash back bonus', but I usually pay the bill off each month. That did not happen prior to the new year and my goal is to not use any previously saved money to pay off the bill.

The paycheck that I got on Friday January 4th was for $807.21. After I deposited it at the bank I did my weekly transfer adding $20 to my vacation fund and I made a $400 payment on my Discover bill lowering it to under $1000, but I will have to use it for gas and a few other things over the next month. I also had $50.59 taken from my check and put into my 401K, pre-tax of course.

Ok... so my current total for 2013 so far is a whopping $20 in my vacation fund and $50.59 in my 401K

Hopefully if this goes as planned I will see you this coming Friday and each Friday following with brief updates on what money goes where.

Feel free to comment with your own stories of saving and spending!

Subscribe to:

Posts (Atom)